HayyaTax: FTA Approved Accounting and Tax Consultancy in Dubai

⚠️ Do you know about deductions in corporate tax? You might bepaying more tax than actual!

CFO Services in UAE

CFO Services in Dubai, UAE

We, Emirates Chartered Accountants Group can support you by providing Virtual CFO services in Dubai, UAE, or on a part-time basis based on client requirements. We can provide outsourced CFO Services in the UAE for a reasonable fee depending on the scope of the assignment. Our experienced members are from IIM and ICAI, who worked as CFO in MNC in UAE for more than 20 years, can support you while taking strategic decisions.

We understand this challenge of businesses and hence we are providing these Strategic CFO services in Dubai, UAE, on a cost-effective basis. A strategic CFO would help them make better business decisions based on sound and timely financial advice. Our Strategic CFO services in Dubai, UAE, helps them to achieve their business goals while building a solid foundation for the company, leading to sustained growth in shareholder wealth.

CFO Services in Dubai, UAE

Role of CFO in Strategy of the organization

In today’s dynamic and challenging business environment CFO plays a very important role in crafting and driving the strategy of the group. CFO plays a very important role in initiating the strategic process by defining the Vision, Mission, and Core Values of the Company, do a SWOFT analysis, analyzed the structure of the industry, and assess the bargaining power of customers, suppliers, and its competitors. He also ensures that operational strategies, KRA of each dept. and budgets are in alignment with the overall strategy of the company.

CFO keeps track of the latest trend in the market and ensures that the strategy of the company is updated in alignment with market dynamics. The shoulder to shoulder with CEO by advising him on the strategic issues and ensuring implementation of strategy at a gross-root level.

CFO acts as business partners

for other departments and helps them to enhance their productivity by analyzing and linking the operational reports with financial reports and thereby help them to manage their function in a better manner and thereby add value to the company.

CFO designs the supply chain of the company

and makes it cost-effective and competitive. They ensure that relationship with all stakeholders including suppliers and customers is maintained properly and make or buy decision is made effectively.

CFO drives digital transformation in the company

as they are the custodian of financial and operational data which can be brought to a single place and analyzed through digital tools and give keep insights to management which helps them in making the decision on a real-time basis.

and gives an excellent insight into the financial performance of the company by present financial reports after an in-depth analysis of the same. They discuss all the strategic issues with the board or investors and ensure that their approval or concurrence is in place before making any strategic move. They craft, present, and drive the budgets of the company after the due approval of the board and investors. They make and present financial models for new projects or businesses to investors and raise funds.

CFO maximizes Return on Investment

CFO ensures that return on the investment made by investors is maximized by optimizing revenue and reducing cost by enhancing productivity and efficiency levels in all areas of business.

CFO drives Cash flow Management of the group

CFO plays a very important role in managing the cash flow of the group effectively by ensuring that short-term funds are not used for long-term purposes and ensuring that funds are allocated to those projects or areas of business that optimize return on investment. They raise funds by developing and maintaining a relationship with banks, financial institutions, and investors and minimize the cost of capital for raising these funds. They manage working capital effectively by optimizing the working capital recycle. They hedge the foreign currency risk by selecting the right hedging instruments after monitoring the updates and analyzing their impact on the pricing of the foreign currency.

They ensure that the company has complied with all applicable corporate laws

They ensure that proper internal controls and processes are in place in each area of business to eliminate possibilities of frauds and errors and identify and mitigate risk. They ensure that best practices are followed including conducting benchmarking for optimizing return on investment.

Acquisitions and Mergers

CFO plays a key role in the growth and expansion of business of the company by ensuring that proper infrastructure is in place including key resources like funds when a company goes for expansion through acquisition or mergers.

Globalization vis-à-vis localization

CFO ensures that each business segment of the organization is scalable to a global level but at the same time each business segment has local flavor by analyzing its growth potential and having an in-depth understanding of various regions of the world.

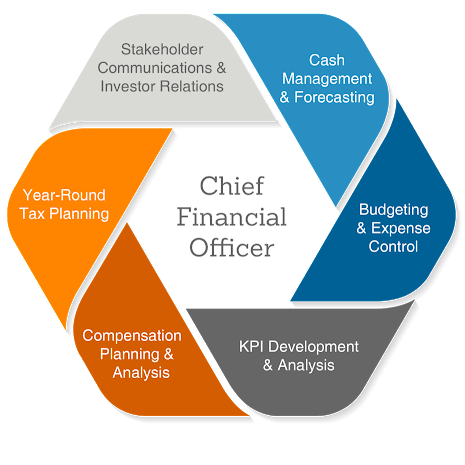

Our CFO Services in the UAE include,

- Formulating Business strategy/Policy and Action Plans.

- Provide support for the preparation of Annual Budgets and it’s a review on a continuous basis

- Guidance for setting up of Internal Control processes

- Guidance for drafting and implementing SOP

- MIS Report Preparation and Analysis of Financial Data

- Cash Flow and Working Capital Management

- Review of Contract with Customers, Suppliers, etc.

- Guidance related to UAE Tax matters

- Guidance and Monitoring Accounting Dept as and when required.

- Support for Cost Analysis in Project Accounting and Construction Contracts

- Provide regular business advice to the CEO/Owners as required

- Support for Pre-Costing and Post Costing Analysis.

- Liaison with Banks and other Financial Institutions.

- Support for handling Working Capital Facility from Banks and other Financial Institutions and to ensure the covenants.

- Risk Management.

"Expert Compliance & CFO Services for Financial Excellence!"

Our team is ready to simplify the complexities for your UAE business.

Frequently Asked Questions on CFO Services in UAE

CFO (Chief Financial Officer) services in the UAE provide businesses with strategic financial management, budgeting, forecasting, and risk assessment. These services help companies optimize cash flow, improve profitability, and ensure compliance with UAE financial regulations without the need to hire a full-time CFO.

Businesses in the UAE benefit from outsourced CFO services because they get expert financial guidance at a lower cost than hiring a full-time CFO. These services help with financial planning, tax optimization, fundraising, cost control, and overall business growth strategy.

A CFO in the UAE oversees financial planning, budgeting, risk management, cash flow monitoring, investment strategies, and regulatory compliance. They provide businesses with insights to improve financial performance and make informed decisions.

CFO services help startups and SMEs in the UAE by providing expert financial planning, securing funding, managing costs, and ensuring compliance with VAT and tax regulations. This enables small businesses to scale efficiently while maintaining financial stability.

The cost of outsourced CFO services in the UAE varies depending on the business size and service scope. Prices typically range from AED 5,000 to AED 20,000 per month, depending on the complexity of financial management required.

To find the best CFO services in the UAE, businesses should look for providers with extensive financial management experience, knowledge of UAE tax laws, and a proven track record of helping companies grow. Checking reviews, industry expertise, and service flexibility can help in making the right choice.

Request Free Consultation

Fill in the form below, and we’ll get back to you within 24 hours.